Home improvement pros feeling more stable after uncertain 2022

The year 2022 was a rollercoaster for the home improvement, home construction and home sales industries. The ups and downs of the first six months made the team at Catapult Insights wonder: What are home improvement professionals thinking today? And what do they expect the future to look like?

To find out, Catapult Insights partnered with online sample provider Full Circle Research to get a pulse on home improvement professionals in the US. The data, collected in August 2022, revealed that this niche audience was still feeling the impact of inflation, supply chain issues and staffing shortages from 2021. And many expected those issues to continue to impact their revenue in the future.

Six months later, Catapult and Full Circle ran the survey again. Here’s what’s changed in the minds of these professionals.

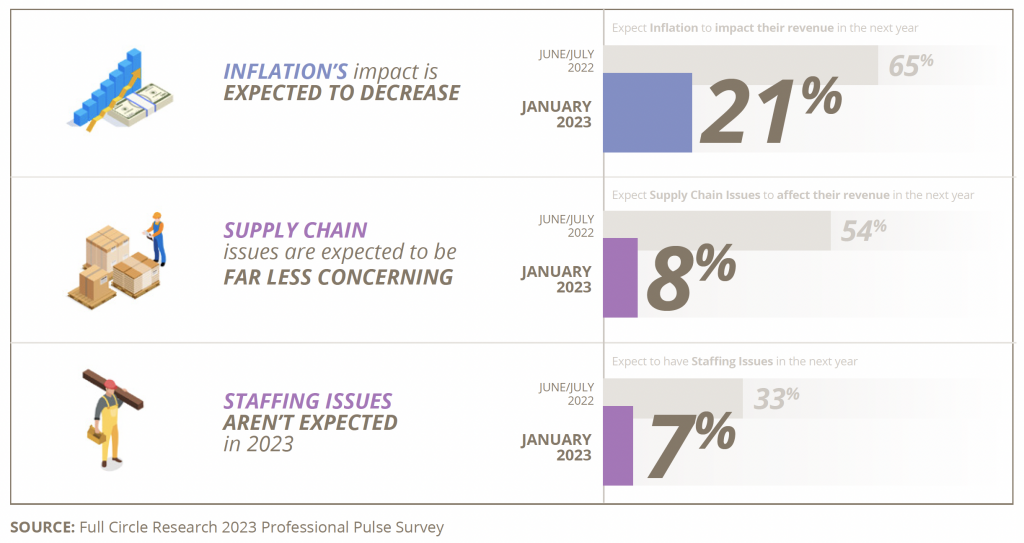

Inflation’s impact is expected to decrease. In 2022, 65% of pros expected their revenue to be impacted by inflation in the next year. Far fewer are saying that today—only 1 in 5 say they expect inflation to impact their revenue in 2023. Have pros successfully regulated the effects of inflation with updated expectations for margins, or is it perhaps that higher costs are successfully being passed down to homeowners?

Supply chain issues are expected to be far less concerning. Half of pros in 2022 said they expected supply chain issues to impact their revenue in the next 12 months; that number dropped to just 8% in 2023. Are supply chain issues a thing of the past or have pros found workarounds that allow them to preserve their revenue streams?

Staffing issues aren’t expected in 2023. Only 7% of pros say they expect to have staffing issues in 2023, which is a significant drop from the one-third of pros who said they expect staffing issues in 2022. Are the number of projects beginning to level out, or are more skilled laborers returning to the trades?

The increased optimism we’re seeing among pros aligns with the shifts that the University of Michigan Consumer Sentiment Index, a well-regarded economic indicator which measures the degree of optimism consumers feel about the economy and their own financial situation, has seen over the last year. The months of June and July were the lowest point for the index (current, future and combined) in 2022, and now all three indexes are up, indicating that consumers overall are more confident about the economy today and in the future than they were just six months ago.

Clearly the home improvement industry is continuing to shift, but what does this mean for durable goods brands and retailers?

Keep a consistent pulse on your customers. In just six months, home improvement professionals went from expecting an uphill battle with inflation, supply chains and staffing to feeling more secure with what the future may bring. The economy is shifting, and people are feeling it, which impacts their behaviors and expectations. During times of constant change, it is critical to keep a pulse on what consumers are doing, thinking and planning, so your brand can be proactive in your marketing and business strategy.

Watch for over-supply in the market. Like the supply chain, a backlog of home improvement

projects may finally be unraveling and returning to a more normalized baseline. This means durable goods manufacturers should be watchful of over-supplying the market—something that’s been on our minds since last year. Keeping a watchful eye on consumer spending behaviors and the Consumer Sentiment Index can help your brand keep pace with demand.

Keep tabs on interest rates and what the downstream effect might be for your business. After a relentless climb last year, interest rates sit at just under double what they were early 2022. High interest rates will likely depress home sales/buying as we move through 2023. People are staying put in the homes they’ve likely already invested some home improvement dollars into over the past two years when home improvement projects were booming. Given this, it stands to reason that demand for home improvement projects might slow down, which potentially means lower supply chain strain and lower staffing needs for pros to upkeep. Brands who stay relevant and innovate will be top of mind for consumers and pros, making them more likely be able to snag a large piece of that home improvement budget pie, even if its overall size shrinks.

Innovate. This one is important: As signs of an apparent recession loom, we can expect more wild swings in pro (and consumer) confidence. This whiplash is challenging to navigate and can have long-term effects on consumer behavior and what people care about most. Be the brand that builds consumer confidence and stays top-of-mind by continually innovating, even when economic times are uncertain. History shows us that brands that innovate during a recession can come out on top. Focus on trends and evolving consumer needs, take risks and work to take your brand and products into the future to meet consumers where they will be down the road.

Article excerpted with permission from Catapult Insights.

More Case Studies

Mini-Mag

Learn more about InstaConnect

For a deeper dive, check out our mini-mag, which includes an exclusive Q&A with Co-CEO Nate Lynch.